Open Banking

Services

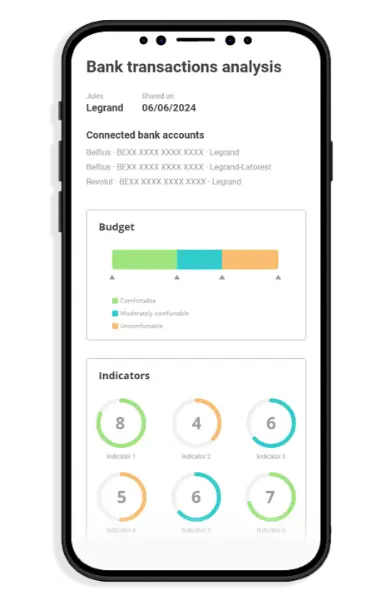

Gain an in-depth understanding of your customer's financial status through automated analysis of their banking transactions.

Make informed decisions based on an instant assessment of your prospects' and clients' solvency.

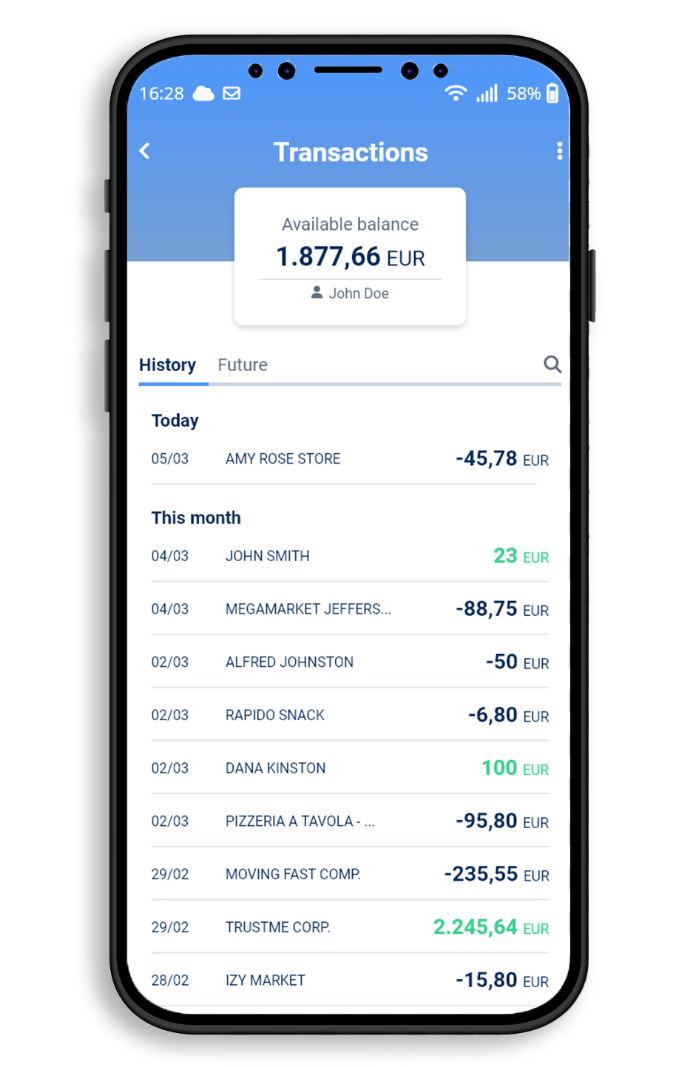

Transactions labelling

Your client's banking transactions organized in 100+ categories focusing on what is relevant for credit scoring.

Budget check

Automated expenses and income identification.

Credit scoring

Evaluate the credit worthiness of your client relying only on the analysis of the banking transactions.

Fraud detection

Detect automatically false information and unusual activities

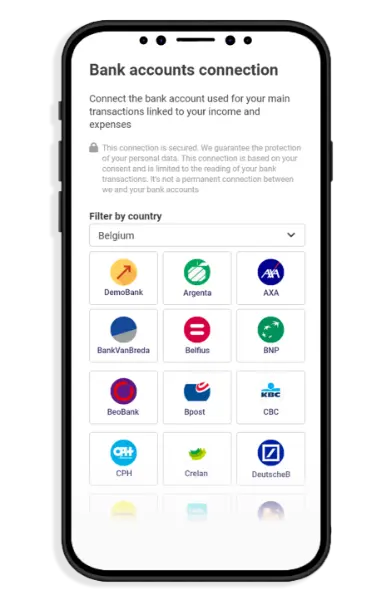

White label platform to manage banking connections

Guided and iterative connection process to extra bank accounts thanks to the assessment of the level of activity/usage on the bank accounts

Data output available in our platform or via API

Matthias Dupont

Transactions labelling

- Broad list of available labelling categories

- Access to raw data fields as well as to derived data fields

- Derived data fields such as derived total income of the borrower or derived salary replacement

- Warnings and alerts

- Reliability score: confidence level in the labelling

Exclusive categorization methodology

Cleaning

Get context(optional)

Information from loan request (or other): co-borrower, declared salary, employer

Payment method

Counterparty extraction

Identify various potential categories

Using different techniques/models

Select most suited category

Based on confidence and priority

SpendTracker Belgium

Discover our transaction labelling in action with SpendTracker Belgium, the first automated study on the expenses and incomes of Belgians, based solely on banking transactions.

DiscoverBudget check

Monthly payment capacity calculation based on your rules.

- No need of long form to be filled in

- No need to gather extra document

- No need of human check.

Based on our exclusive categorization methodology we give you a full view on the income and expenses of your client up to 12 months in history.

Credit scoring

- Credit worthiness score

- Possibility to rank the computed score using a payment default model and the related expected likelihood.

- Customizable scorecard

Matthias Dupont

Fraud detection

- Real time access to users' financial data

- Automated confirmation of other evidences information.

- Account holder identity verification

- Unusual activity detection

Effortless integration with your current processes

Fintensy white label platform to manage banking connections : requesting financial information from your customers is now more secure and simpler than ever before.

Already managing your clients' bank connections? Send banking transactions to Fintensy by API, and we'll process and return them to you

Discover our expertise

in action

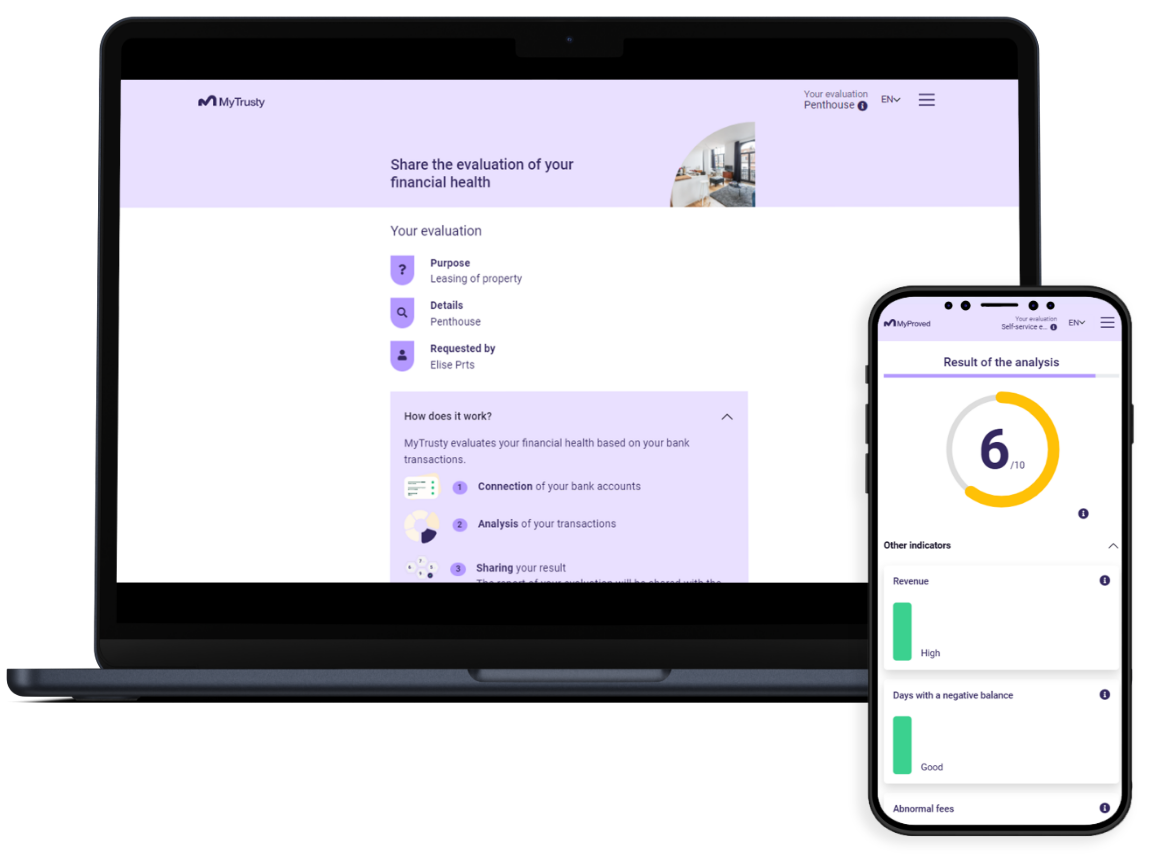

MyProved · Evaluate the financial health of an individual with a single click

MyProved is a trusted third-party providing evaluation of the (re)payment behavior of an individual.

The individual's financial health assessment is performed through the analysis of bank transactions collected using Open Banking connection and based on the individual's consent.

Discover

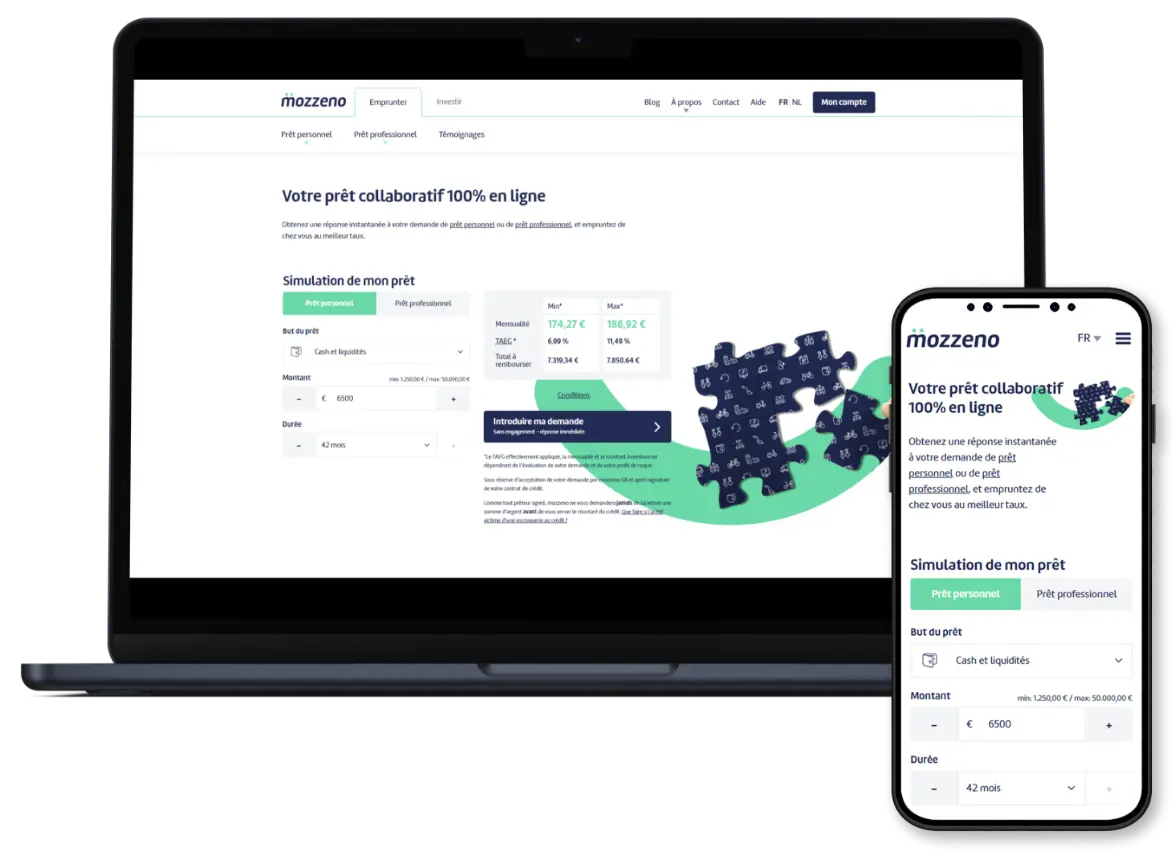

mozzeno · Lending platform

mozzeno uses Fintensy's Open Banking services to accelerate borrower onboarding, automatically verify their data, detect fraud and assess their creditworthiness.

Discover